SALEM FIVE

MUTUAL INTEREST

Information to keep you moving forward.

Promotion

Checking Sweepstakes Winner

This spring, we conducted a checking sweepstakes where all new checking account customers were automatically entered for a chance to win a fabulous prize showcasing the Power of Five. Ronda A. from Stoneham was randomly chosen from all new customers. Recently, she met us at the Stoneham Square branch to receive some Salem Five goodies and get her picture taken. And, now she just needs to decide where to go….she was debating between a 5-night stay in Aruba or Nashville. Right now, she's leaning toward Aruba. Thank you Ronda for choosing Salem Five to do your banking and enjoy your trip!

Mortgage

Construction/Renovation

If you're planning to build a new home or take on a major renovation, Salem Five’s Construction and Renovation Mortgage is designed to help simplify the process. Salem Five is one of the only mortgage companies locally that offers this. With just one closing, you can finance both the construction and permanent mortgage - saving time, money, and stress.

If you're planning to build a new home or take on a major renovation, Salem Five’s Construction and Renovation Mortgage is designed to help simplify the process. Salem Five is one of the only mortgage companies locally that offers this. With just one closing, you can finance both the construction and permanent mortgage - saving time, money, and stress.

Our loan offers interest-only payments during the construction phase and automatically converts to a traditional mortgage once your project is complete. Whether you're working with a contractor on a north shore custom build or turning a fixer-upper on Cape Cod into your dream vacation home, we make it easy to fund your vision.

Salem Five Mortgage Company is your partner for local decisions and expert support every step of the way. Ready to break ground? Learn more about your options and apply today.

About Salem Five Mortgage Company

Salem Five Mortgage Company, LLC lends in MA, ME, NH, RI, & FL. Mortgage products provided by Salem Five Mortgage Company, LLC, NMLS ID 4662. Rhode Island licensed loan broker and loan lender.

Product Information

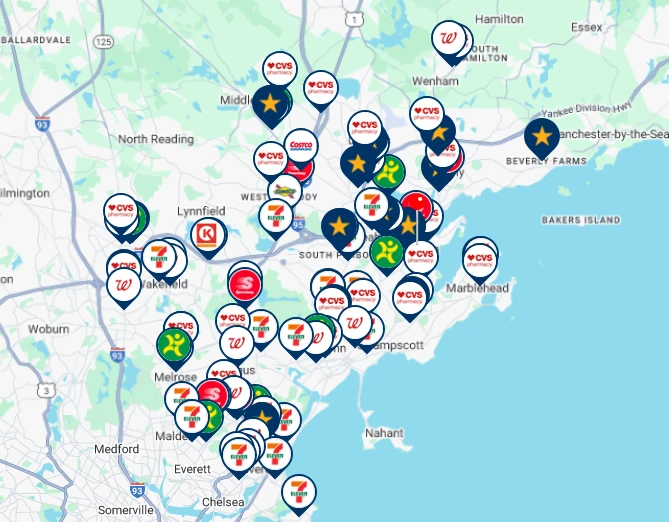

Fee-free ATMs with Allpoint®

Did you know? As a Salem Five Visa® debit cardholder, you have free access to more than 55,000 ATMs nationwide. Of course, all ATMs at our 30+ branches are free to use. In addition, through our partnership with Allpoint®, you also have fee-free access to all Allpoint® network ATMs.

We believe that getting cash should be easy…and FREE. And with the Allpoint® network, you have convenient access to ATMs in locations you go to regularly. Places such as CVS/pharmacy, Walgreens, Target, Speedway, among others.

To see where the nearest fee-free ATM is to you, you can:

- Visit salemfive.com/allpoint

- Go directly to allpointnetwork.com

- Download the Allpoint® app

- Or access the list of Salem Five locations and ATMs via our mobile app

Financial Planning

Overview of How New Legislation will Affect Taxpayers

With new legislation, there can be major implications for financial planning. And, with a bill as large as the 870-page one that just passed into law, there are pros and cons for different taxpayers. Here are some highlights to consider and discuss with your wealth advisor. These are just a handful of the changes, but the biggest takeaway is certainty – knowing these are the rules for the foreseeable future can help you plan. If you have any questions about how the new law might impact your financial plan, feel free to reach out to your advisor to discuss options.

- Tax cuts enacted in 2017 have been extended or made permanent. This includes current brackets and marginal rates, the estate tax exemption and the standard deduction increasing to $15,750 for individuals and $31,500 for joint filers.

- The cap on the State and Local Tax deduction (SALT) will temporarily increase from $10,000 to $40,000 for tax years 2025-2029 with a 1% annual increase over the 5-year period and a phase-out for higher incomes. This will aid clients in high-tax states, but reverts back to $10,000 in 2030.

- Starting next year, anyone using the standard deduction will be able to claim a deduction for charitable contributions of up to $1,000 for single filers and $2,000 for joint filers.

- For anyone 65+, there will be a deduction of $6,000 for individuals and $12,000 for joint filers. This new senior deduction is only for tax years 2025-2028 and starts to phase out for higher incomes.

- The bill creates a new savings account for children, a ‘starter IRA’, which can be funded up to $5,000 per year and is similar to non-deductible contributions of a traditional IRA. At age 18, the account converts to a traditional IRA. For babies born Jan 1, 2025 – Dec 31, 2028, they would qualify for $1,000 in federal seed money to start the account.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Salem Five Bank and Salem Five Wealth Advisors are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using the name Salem Five Wealth Advisors, and may also be employees of Salem Five Bank. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of Salem Five Bank or Salem Five Wealth Advisors. Securities and insurance offered through LPL or its affiliates are:

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Salem Five Bank provides referrals to financial professionals of LPL Financial LLC (“LPL") pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. Salem Five Bank is not a current client of LPL for advisory services.

Please visit: https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html

LPL Financial Form CRS