SALEM FIVE

MUTUAL INTEREST

Information to keep you moving forward.

Digital Banking

eStatements: convenient, secure and green

We encourage all customers to opt for electronic statements vs. paper. Accessible anytime through online banking, there’s no more waiting for mail delivery.

With online banking’s robust security measures, it’s stronger protection for your sensitive account information. Seven years of account history are easily accessible. And, eStatements has the added benefit of being better for the environment by saving paper. When your statement is ready, you’ll receive an email letting you know it’s available.<.p>

Economic Insight

Economic Outlook for Fall 2024

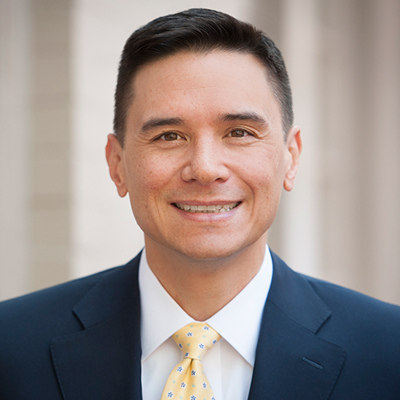

As the year starts to wind down, it’s a great time to focus on updating your financial picture so that you can have peace of mind regarding your financial situation as you prepare for the next year. Here are five key year-end financial planning moves to consider. Read the full article here for important details or watch Sean Tesoro, President of Salem Five Wealth Management & Trust explain the five tips in the video below:

1. Review your Overall Financial Plan

2. Review Your Employee Benefits and Retirement Contributions

3. Conduct a Year-end Tax Review

4. Make Charitable Donations and Give Gifts

5. Review your Estate Plan and Insurance Coverage

So, as we head into the fall, it’s a good time to review your financial planning and make adjustments so you can start 2025 off strong!.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Salem Five Bank and Salem Five Wealth Advisors are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using the name Salem Five Wealth Advisors, and may also be employees of Salem Five Bank. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of Salem Five Bank or Salem Five Wealth Advisors. Securities and insurance offered through LPL or its affiliates are:

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Salem Five Bank provides referrals to financial professionals of LPL Financial LLC (“LPL") pursuant to an agreement that allows LPL to pay the Financial Institution for these referrals. This creates an incentive for the Financial Institution to make these referrals, resulting in a conflict of interest. Salem Five Bank is not a current client of LPL for advisory services.

Please visit: https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html

LPL Financial Form CRS

Mortgage Insight

How the Economy is Affecting the Mortgage Industry

The economy, and as a result, the mortgage industry is experiencing significant changes. The Federal Reserve recently approved a half point rate cut in September, which was the first one since 2020. And, economic conditions may continue to support future rate cuts, as the data the Federal Reserve consumes to set their policy centers around their primary mission to keep inflation at a controlled pace. The target is an annual 2.0% inflation rate. Reports such as manufacturing activity, unemployment, and monthly inflation readings are important to their policy stance and they will be watching these indicators closely.

Even prior to the recent rate cut, mortgage rates had already improved, based on the projected cuts. I would anticipate a long, slow ride down for mortgage rates over the coming quarters if inflation looks to continue its cooling trend. In contrast, I believe we will continue to see real estate values increase in New England, as they have done so since 2012, because of basic supply vs. demand dynamics. With most listings receiving multiple offers from potential buyers, it highlights the continued demand that is not being met. Where lower rates will improve affordability for buyers, I expect this supply-constrained market to continue, resulting in an ongoing challenging market for buyers.

Many lenders believe the past two-plus years of a much higher rate environment has begun to condition the buying population to a new normal of interest rate environment. I have heard the term “rate realization” being used to describe this. With this new perspective, it will be interesting to see what rate is now considered “low” enough to see a marked uptick in activity. Only time will tell.

As history has revealed, inflation can be stubborn. If we see economic reports that are indicative of a higher rate of inflation affecting the economy, we will likely see mortgage rates quickly and sharply trend higher as a result. I am sure the Fed Board of Governors is sensitive to this, and we would see at least a pause in their series of proposed rate cuts to stem this.

Mortgage seekers should watch the economy and rate fluctuations, but to a degree. There are products that are built for conditions such as this – and have been leveraged in prior economic environments – such as adjustable rate mortgages and some of Salem Five’s proprietary portfolio products. We at Salem Five have been helping New Englanders buy homes for generations. We’ve seen it all.

Retail News

Building a new Burlington branch!

We have some exciting news for customers of our Burlington location. Over the coming months, we will be completely re-building the branch. The new location will be bright, modern and more energy efficient. It will also be roomier, providing a more comfortable space to discuss financial solutions with customers. And we will still offer a convenient drive-through for those preferring to bank on the go.

As this is a major construction project, the branch located at 36 Cambridge Street will be closed. However, a temporary branch is now open at 28 Cambridge Street to serve the needs of the Burlington market while the main building is under construction. This is a mere 500 yards from the current location. These are exciting changes for the Burlington market and Salem Five.