SALEM FIVE

MUTUAL INTEREST

Information to keep you moving forward.

Digital

Go Green and Go Paperless!

Current Promotions

Great Rates to Grow Your Savings

Salem Five CDs and Money Market accounts are great ways to grow your money. Check out our competitive rates, including a 4.50% APY 18-month CD or IRA CD special as well as other attractive options. Click here to learn more or apply online. Or, visit a Salem Five branch near you.

Partnership

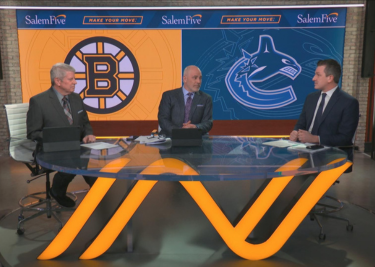

Salem Five & NESN Collaboration Going Strong!

With our partnership in its second year, Salem Five was thrilled to watch the Bruins throughout their historic season (and mourn the end of it) and kick off Sox season in style. Be sure to tune in to Sox away games on NESN from the beautiful Salem Five NESN Studio. We’ve enjoyed collaborating with NESN over the year and thankful for the relationship we’re building. See below for some recent images/clips of the studio in action.

Economic Insight

Who Wants to be a Millionaire? Maybe not as many as before.

By Sean Tesoro, President

Salem Five Wealth Management and Trust

With the 2022 tax filings behind us, the temptation is there for people and businesses to forget about next year’s filings for a while and enjoy the arrival of spring here in Massachusetts. That, unfortunately, could be a costly mistake, thanks to the new Massachusetts Millionaires Tax, or what is sometimes called the Fair Share Amendment. Approved by state voters in 2022, the tax adds a 4% income tax on the portion of annual income in excess of $1 million. However, it isn’t just high earners who are affected by this new tax. On a one-time basis, it could also impact the sale of a home, a business, securities or other assets. It’s unlikely that voters realized how widespread this tax would be applied. In 2022, 88,723 homes were sold in Massachusetts and 13,165, or 15% sold for more than $1 million. In Essex County, 1,206 homes sold for $1 million.

The new law has several potential consequences as people and business owners try to minimize its impact on their tax obligation, including changes to how property sales are structured, installment sales for business owners, changes in filing status – particularly for married couples – and the possibility that residents and businesses will relocate to another state.

We’ve also seen a renewed interest in Trust and Estate planning, given the possibility of these vehicles being used to offset the impact of the tax. In other words, people and business owners are already planning. And that’s a good thing. Taxpayers need to ask:

- Will I be impacted and, if so, when?

- Have I explored options with my financial partners, such as my spouse or co-owners of a business?

Further complicating the matter for taxpayers are proposed changes to other taxes made by Gov. Maura Healey, such as the elimination of the estate tax for all estates valued up to $3 million and the reduction of the short-term capital gains tax from 12% to 5%. It’s unclear whether the House and Senate will embrace these changes and, if they don’t, how hard the governor will push back. If the governor is successful, however, these changes could possibly offset the increases brought about by the Millionaires’ tax.

Despite the uncertainty, we do know that our partners in the accounting industry are working on tailored solutions for their clients. Indeed, whether you are an accountant or an individual looking to preserve assets, the key to having a successful 2023 tax filing next year is to begin planning now.

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker/dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Salem Five Bank and Salem Five Wealth Advisors are not registered as a broker/dealer or investment advisor. Registered representatives of LPL offer products and services using the name Salem Five Wealth Advisors, and may also be employees of Salem Five Bank. These products and services are being offered through LPL or its affiliates, which are separate entities from and not affiliates of Salem Five Bank or Salem Five Wealth Advisors. Securities and insurance offered through LPL or its affiliates are:

The Salem Five Investment Services site is designed for U.S. residents only. The services offered within this site are offered exclusively through our U.S. registered representatives. LPL Financial registered representatives associated with this site may only discuss and/or transact securities business with residents of the following states: AL, AZ, CA, CO, CT, DC, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MA, MD, ME, MI, MN, MO, NC, NH, NJ, NY, OH, OK, OR, PA, RI, SC, TX, UT, VA, VT, WA, WI, WV

18-Month CD or IRA CD Special Disclosure:

1 Annual Percentage Yield (APY) current as of 9/17/2024 and subject to change. Minimum $2,000 to open and obtain the disclosed annual percentage yield. Substantial penalty for early withdrawal. Fees may reduce earnings. Maximum deposit is $500,000.

Gold Star Money Market Special Disclosure:

2 The Annual Percentage Yield (APY) is accurate as of today. 3.70% APY earned for balances $50,000 or more; 0.10% APY earned for balance $0.01 - $49,999.99. Rate may change after account is opened. Fees may reduce earnings. Personal accounts only. Minimum deposit to open is $10. Offer available for funds not currently on deposit. Maximum deposit limit is $1,000,000 per account and one account per customer.